How Nano Dimension CEO Burned 1 Billion Dollars Creating A Deep Discount Asset Play

NNDM offers a rare negative enterprise value asset play, with a strong balance sheet and significant margin of safety despite past mismanagement.

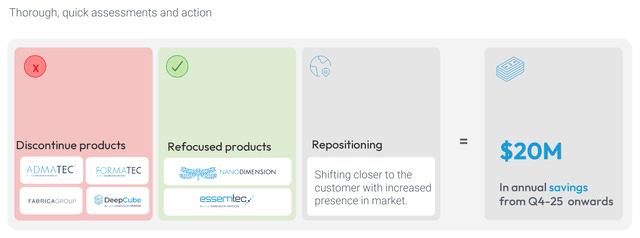

New management, backed by major shareholders, is aggressively cutting costs offering hope for a turnaround.

Even in a liquidation scenario, shareholders could see a 50%+ premium, while operational improvements or a buyout could drive shares much higher.

With revenue set to double and a unique AME/PCB/SMT niche, NNDM is well-positioned if management avoids past mistakes and industry demand holds.

3D printing had a second bubble in 2020. Thanks to covid, additive manufacturing looked like the obvious solution for our new supply chain-strained world. In 2020 the Fed funds rate hit 0% and margin was cheap - IBKR margin rates fell below 1%. Stimulus checks were cashed and robinhood retail traders were speculating from home. SPAC decks promised years of pie in the sky 80% revenue growth while crazy aunt Cathie Wood and her ARKQ/PRNT ETF's amplified the 3D printing hype for everyone in the space. (In fairness to Cathie, PRNT has only fallen 50% in the same period NNDM tumbled 90%)

Nano Dimension Ltd. (NASDAQ:NNDM) specializes in Additively Manufactured Electronics which allows for rapid PCB prototyping and enables DOD contractors, NASA, and others to shirk reliance on foreign fabs (They make machines that squirt conductive ink).

Management took full advantage of the renewed 3D fervor and began aggressively raising money through equity offerings - which was a very good move. By the end of Q1 2021 they had raised a staggering 1.5 billion dollars. They then spent the next 4 years burning a billion dollars through overpriced, arguably interest conflicting, acquisitions and the aggregate operational losses they accrued - this was decidedly less good. Turns out the safety provided by a huge pile of cash is limited by the rate at which huge fools spend it. Instead of getting a dollar for 70 cents these bad boys from Tel Aviv were spending a dollar to be indebted for 26 cents. In under 4 years they made 8 acquisitions of unprofitable companies mostly within the industry spending just over $500,000,000 to subsequently lose millions more running them at a loss. This kind of big brained M&A activity requires top executive talent and they paid out $125,000,000 in stock based compensation for their unrivaled talent. Today 5 of the 8 acquisitions are shuttered or bankrupt.

By the time activist investors at Murchinson Ltd. wrangled control of NNDM at the end of 2024 they had roughly 450m left of the 1.5b war chest (after accounting for the estimated impact of the DM and Markforged acquisitions). The former CEO Yoav Stern successfully delayed his ousting by adopting and renewing a poison pill plan, turning down a $990,000,000 buyout offer from Murchinson representing a 52% premium to shareholders, was voted off the board by shareholders in an extraordinary general meeting but just ignored it contesting ADR shareholders right to have a vote, he then delayed another EGM citing the war in Gaza, and made a failed bid to give himself 10% of the company for pennies by attempting to reduce the exercise price of his options from $6.16 dollars per share to $2.46 dollars per share (shares traded at $2.36 at the time). A true warrior, Stern went down fighting and spent millions of Nano Dimensions cash reserves on lawyers in the process.

For their part Murchinson has been largely uncommunicative in the 9 months since assuming control but the brief Q1 2025 earnings call showed they can aggressively cut costs and for the first time in 39 quarters the stock based compensation was a negative number. As Stern said in the 2023 Q1 earnings call, “We can turn this company, which we will, profitable very quick”. Perhaps it is possible and the man who presided over 2 accidentally profitable quarters in 20 is right. The Q2 earnings this month will be messy as it's the quarter in which Desktop Metal was regrettably acquired for $179,300,000 and shortly thereafter declared bankruptcy. For their part Murchinson vehemently opposed the acquisition claiming they could wait and buy DM for pennies on the dollar or not at all during bankruptcy. Unfortunately Yoav Stern inked that ill fated deal as his swan song to NNDM investors.

We will see what the combined books look like for Nano Dimension and their recent surviving acquisition: Markforged, a business with a commensurate cash burn to Nano Dimensions core business (roughly ~$62,000,000 in the TTM before they were acquired). The CEO who replaced stern, Ofir Baharav, spoke optimistically of Markforge saying it “has shown great promise in terms of its software, including machine learning, systems installed base on manufacturing floors, and organizational structure that can enable Nano Dimension’s accelerated growth.”

Baharav spoke honestly about the liabilities and liquidity issues of Desktop Metals and incurred over 28 million in legal fees trying their best to back out of that deal, so his praise for Markforge is likely not lip service.

I have tepid confidence that the new, mostly american, management installed by the canadian investment firm can turn around this Israeli company with offices across 7 countries. Lucky for us the market price has yet to reflect a shred of optimism. The Enterprise Value remains firmly negative as if it's just wealth destroying business as usual. This creates a massive margin of safety in what is essentially an easy asset play that happens to include 2 innovative but unprofitable businesses in a once very hyped industry which is now begging you - in fact paying you to invest in it.

If Murchinson goes full corporate raider and moves to liquidate, unlikely by their comments, long time investors are out of luck but the current 300M market cap / $1.38 share price sits squarely in the gravy zone. They could sell both Nano Dimension and Markforged for a dollar next week, divvy out the balance sheet and shareholders would still conservatively receive a 50% premium on the existing share price before taxes. If they find an outside buyer for one or both businesses or plan to tender another reasonable buyout themselves ~740m would be a conservative estimate which would land us in what finance professionals call the deep gravy fun zone at $3.42 a share.

What I expect to happen is an honest effort to right the ship, the incentives are properly aligned and the people in charge are themselves working at the behest of major shareholders. Major shareholders that bought in at roughly twice the current market cap. If the ship can’t be righted, pending shareholder approval and Israeli solvency test regulation, they can dole out cash and their 9,695,115 shares of Stratasys valued at ~109,000,000 (They are the second largest shareholder in SSYS at 11.3% the result of a prior failed takeover). Like all Yoav Stern moves he overpaid for SSYS but despite being down, Stratasys has rebounded recently and has risen 66% over the last year. These actions alone would return over $2.0 a share to shareholders and they can then spinoff, shutdown, or sell portions of Markforge and NNDM core business then allow what remains to recapitalize and be valued appropriately without the lingering risk it poses to the sum of its cash and equity investments.

We are seeing for the first time major nimble challengers to the defense primes with Anduril and Palantir, accelerated innovation and rapid prototyping in the aerospace and automotive sectors - all areas where Nano Dimensions core competencies can be utilized. Share buybacks would signal the new management's confidence in the underlying business and a significant 10% repurchase could be utilized for less than they spent on lawyers last quarter but I’m equally pleased by the prospect of a swift buyout offer or any other guaranteed method of unlocking immediate shareholder value.

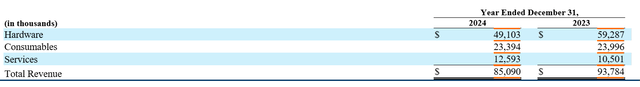

NNDM is competing in an industry with more bankrupt corpses than profitable competitors. But the margin of safety here is immense, they have a unique AME/PCB/SMT niche, revenue (and expenses) should double next quarter thanks to Markforged, and they have a better balance sheet than all their competitors. They could buy $MTLS or $DDD tomorrow while $SSYS has already deftly escaped total acquisition. It’s not often you can invest in cutting edge technology at negative Enterprise Value. Additive manufacturing is foundational to the 4th industrial revolution - or so I’ve read on blogs that use sexy terminology. From defense to dental and satellites to shoes the machines Nano Dimensions manufactures are in use. Their business appears highfalutin but ultimately it's a classic razor and blades model - sell the machines and then continue to sell the materials, support, and maintenance services. In 2024 Markforged and Nano Dimension combined derived 35.7% of their revenue from that important consumables and services portion of their business up from 31.2% the year prior. As the high margin segments grow profitability will follow.

The stock price is stuck in a state of max pessimism while their management and outlook has already massively improved. A classic case of follow the raider. Their ability to compete against the dwindling competition in the space and to fend off cheap chinese challengers like Farsoon in the future will determine where they go in the next 5 years. But success in the next 5 months is much simpler, management just needs to announce a path forward and unlock the value sitting on their balance sheet.

Given the current share price and average daily trading volume they are rate limited to around 18m of share buybacks per quarter. It will take years to return a third of the estimated 475m left on their books through buybacks alone and I get the feeling Murchinson wants more immediate results. I would like to see a special dividend of $1.92 announced (139.1% dividend yield) and to retain shares in a leaner business focused on profitability free from the M&A / G&A campfire that Yoav Stern and his board kept fed for far too long.

I’m long NNDM and a repeat college dropout, not your financial advisor. This is opinion/entertainment, not investment advice. Do your own research; you can lose money. I may buy/sell anytime without notice. No compensation from any company mentioned. Position Initiated August 2025; avg cost ≈ $1.39