GAMB Stock: Dirt Cheap Pick-and-Shovel Gambling Growth Play

Trading at 4x FCF guiding for double digit revenue growth

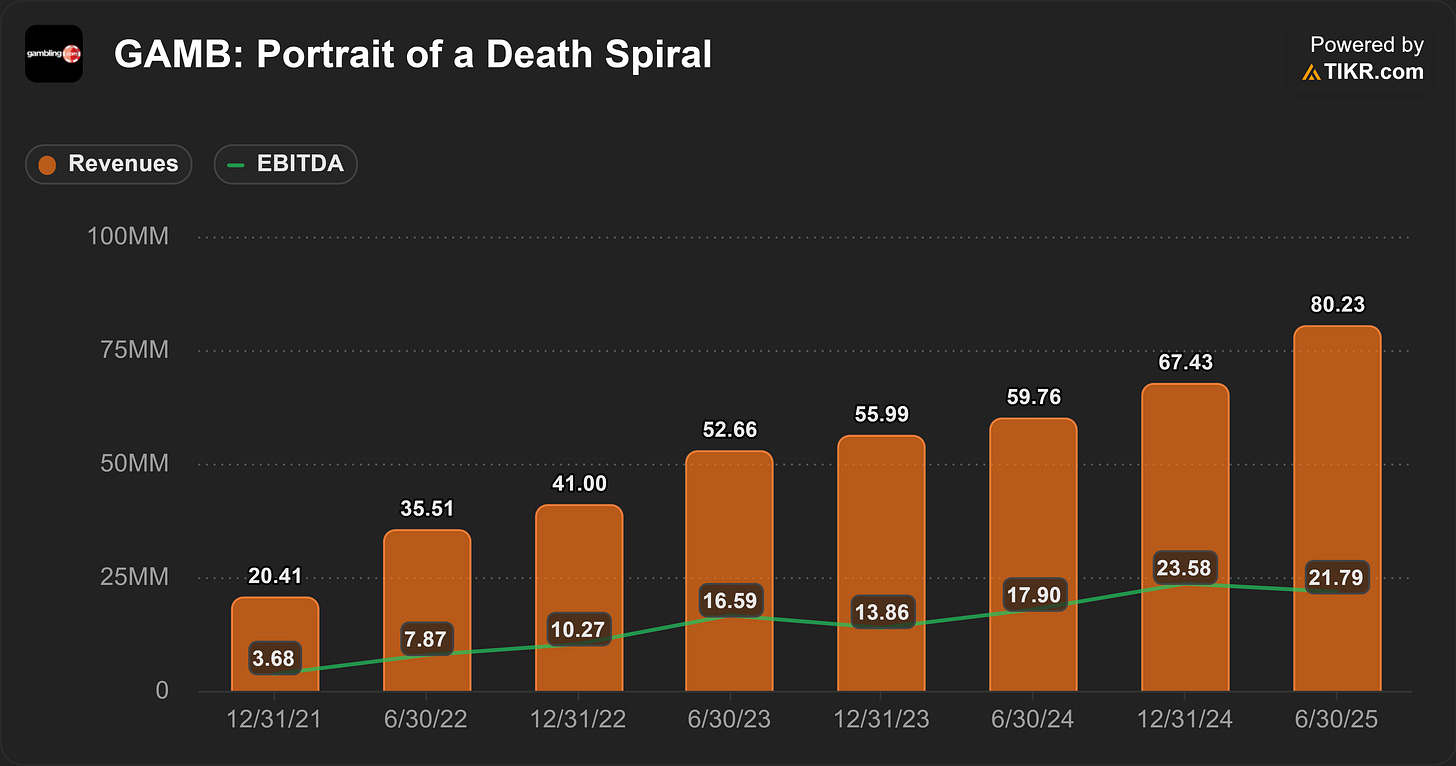

GAMB is a healthy double-digit growth stock trading at a “death spiral” multiple.

Non-SEO channels are expected to exceed search-driven revenue in Q4 2025, significantly de-risking the business.

As the SaaS segment outpaces the affiliate business a multiple re-rating is likely.

The company’s current market cap is now roughly equivalent to the conservative purchase price of just its 2025 acquisitions.

Two companies, both alike in dignity, below fair value, where we lay our equity…

The best two investments I’m aware of today are highly profitable - founder led - beat down businesses that operate on opposite ends of the Gambling industry. Gambling.com Group (GAMB) is an affiliate marketing business rapidly transitioning to sports data services and growing reliable recurring revenue. DoubleDown Interactive (DDI) runs a social casino game and is expanding into online casinos while sitting on a mountain of cash.

Stated plainly, GAMB sends customers to online casinos and sportsbooks on commission and now sells odds data directly to bettors and sportsbooks. DDI dubiously prints money from a freemium app store slot machine ‘game’ - it’s not regulated as gambling because the in-game tokens are worthless, they have expanded into regulated online casinos through recent M&A.

In other words both businesses have a slowing high margin core business segment and a rapidly growing recently acquired tangential business. In both cases the cash these businesses kick off is so substantial relative to the current share price and prospects that it’s positively preposterous. Today we will dig into Gambling.com Group and we’ll look at DDI in depth in a later companion piece.

Business Overview & Prospects (Does a Durable competitive advantage exist?)

For the last 12 months the Total Enterprise Value / Unlevered Free Cash Flow of GAMB is 4.5x and DDI is 0.11x. Both just barely edged out Palantir’s attractive EV/FCF multiple of 342x.

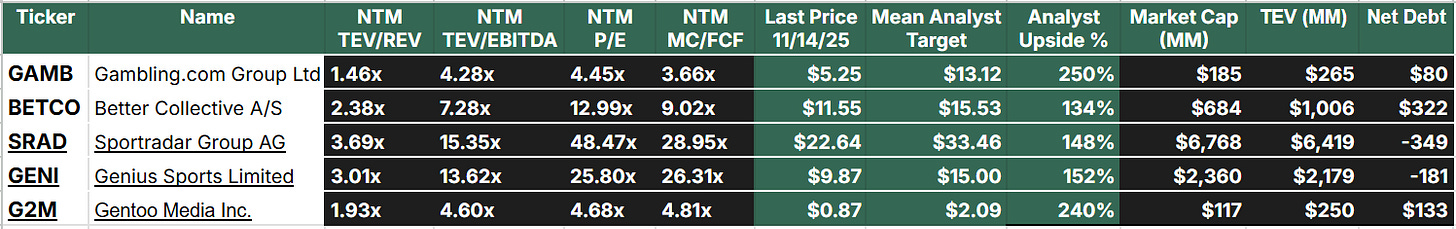

A more accurate comparison to GAMB’s cohorts above shows their depressed valuation.

The core affiliate and advertising segment of GAMB’s business accounted for 76% of its revenue in Q3 ($29.8MM) and the data services segment is a rapidly growing 24% ($9.19MM) that could surpass their core segment in top line revenue as early as 1H 2027. Before 2025 the data services segment was primarily Rotowire, their B2C fantasy sports subscription service, so the segment experienced explosive growth as a result of its Odds Holding acquisition in 2025 recording 304% YOY revenue growth in Q3 2025. OpticOdds in particular experienced 100% YOY revenue growth in Q3, this segment contains the longest term contracts from sportsbooks, prediction markets, market makers, and media who buy their odds data and related services which improves the reliability of GAMB’s revenue as it grows.

“Given the long runway we have for consistent growth in our sports data services business, we believe that this exciting future will be the core of GAMB” —Charles Gillespie (Q3 2025 earnings call)

GAMB has long run affiliate marketing across more than 50 high authority websites cost-effectively connecting gamblers to second and third tier online casinos and sportsbooks at gross margins well above 90%. Fixed costs for that segment amount to a few bucks per year on domain renewals and hosting fees. (The Data Analytics segments spends a few million a year on compute for their high frequency data aggregation and dissemination so gross profit margin takes a hit but the operating margins are still within range of the healthy high margin affiliate business)

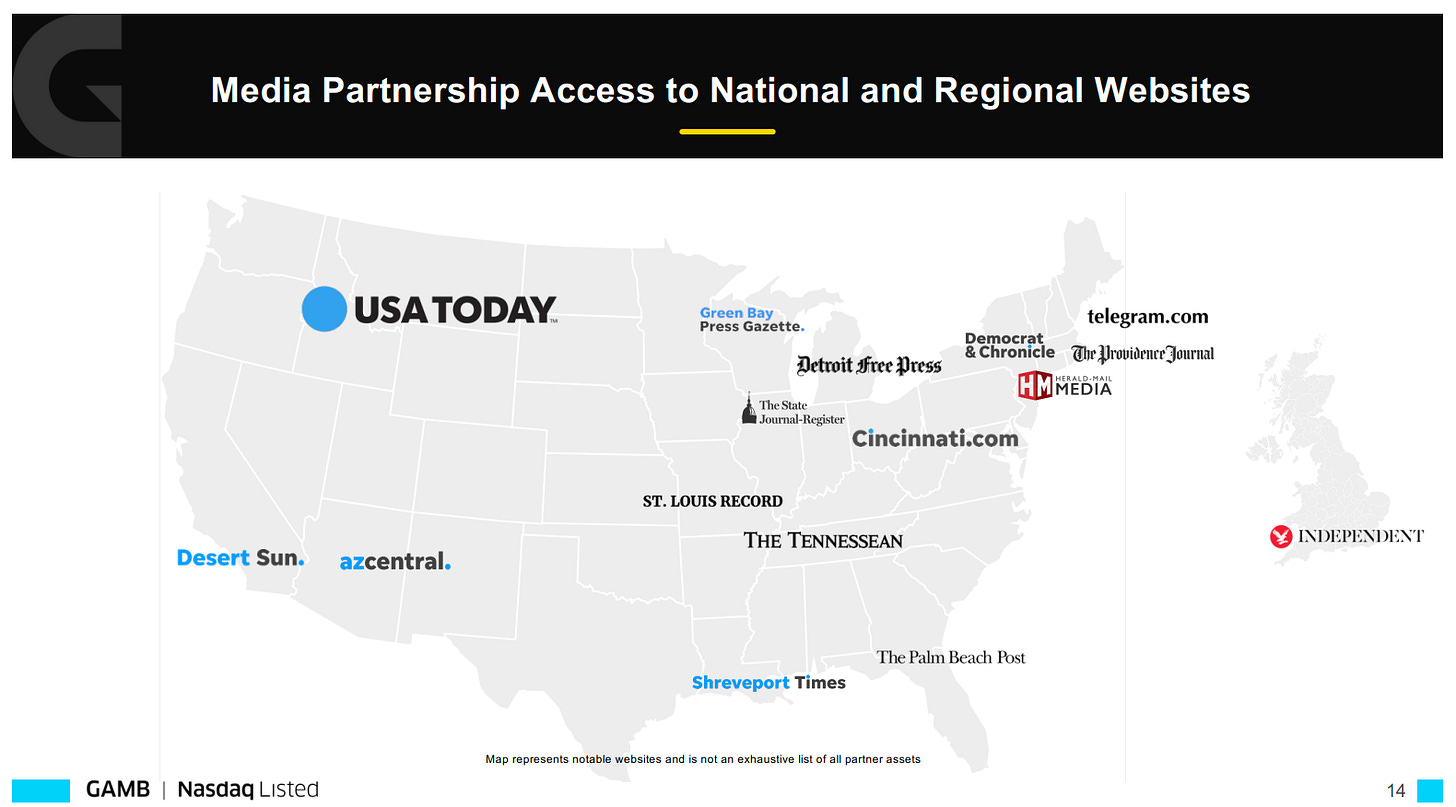

They have grown that revenue and profit rapidly, revenue is up over 900% over 7 years, while maintaining high margins since they require no capital intensive physical assets and avoid the regulatory risk inherent in almost every other corner of this industry. Yet their P/S and EV/FCF multiples continue to compress - in complete contrast to reality. The business is better than ever and the team has prudently reduced their dependence on google search by expanding their non-SEO affiliate revenue across email, social media, and revenue share partnerships with sites like USA TODAY where GAMB handles all their on site affiliate gambling advertising.

“In Q4, we expect to generate more revenue from non-SEO channels than SEO for the first time as a public company.”

—Charles Gillespie (Q3 Earnings Call)

The other half of this diversification effort has been three acquisitions, most recently Spotlight.vegas, Rotowire, and Odds Holdings (OpticOdds & OddsJam). I’ll go in depth on the others in the future but for brevity we will focus on the most fruitful so far, OpticOdds. This is their B2B low latency sports odds data business which is expanding beyond odds data into an all in one platform solution offering bet acceptance, settlement, and risk management to growing small and medium sized sports betting platforms. The Jan 1 2025 acquisition was structured as $80MM upfront and $80MM in performance based earn-outs and by successfully doubling revenue this year management expects to happily pay those earn outs.

“OddsJam and OpticOdds are doing really well. They are in a good position to capture most, if not all, of the contingent consideration in respect of 2025. That means that we will owe them $40 million in April ‘26 and $20 million in April ‘27” —Charles Gillespie (Q3 Earnings Call)

This re-evaluation of the earn out likelihood incurred a non-cash accounting expense which likely spooked some looking at the GAAP Net loss reported in the third quarter. Whatever the case the stock price took a 23% single day dive dropping from $6.84 to $5.25 per share. It went on to reach its 52-Week low of $4.60 a week later. An odd reaction to record revenue, and a rare opportunity to invest in a healthy growing company for 180m the very same year that they made a homerun acquisition for a much smaller healthy growing company for $160MM. In fact when you include Spotlight Vegas, the value of Gambling.com Group’s 2025 acquisitions are now greater than their current market cap.

Valuation: Expectations and Reality

As we close out the year management expects to end Q4 2025 with a record $46MM in revenue and EBITDA of $15.41MM. This would bring FY 2025 revenue to $165.2MM with $51.7MM in EBITDA (Up from $127MM revenue and $41.4MM EBITDA 2024). In a recent interview the CEO hinted at outperformance of these Q4 numbers as a result of strong performance from Missouri’s online sportsbook legalization in November.

“If we turn into 2026, we expect to see overall revenue growth in the low-teens…in Q3, our EBITDA margin was 33%...Our Q4 guidance looks towards 33%, 34%. I think that’s pretty indicative for our expectations for 2026.” -Elias Mark CFO

Next year management expects revenue growth of ~14% and EBITDA margins of ~33.5% which represents a 7.4% relative margin expansion and an absolute increase of 2.3% from 2025. That implies $188.3MM / $63MM of 2026 revenue and EBITDA respectively. If their $51.7MM 2025 EBITDA number is correct that would give us 21.8% EBITDA growth next year, far cry from a business in decline.

The company bought back 562,222 shares at an average price of $8.33 in Q3 and they have the buyback budget ($14.4MM) and the trading volume to allow them to repurchase five times as many shares in Q4 if they so choose.

Growth through acquisition is rarely a winning strategy but CEO Charles Gillespie and his team seem to have hit a homerun with Odds Holding. They now have a new portion of recurring revenue growing 100% YOY (Optic Odds) and despite a recent stumble their core business has been no slouch itself organic growth in the affiliate marketing business averaged 50% from 2017 to 2024. Most recently falling from 41% in 2023 to 2% in 2024. They don’t have DDI’s massive cash pile but they have reasonable debt and multiple binary state legalization outcomes likely to occur in the next 18 months all of which are not priced into their guidance.

All told GAMB has sextupled EBITDA and quadrupled revenue since 2021 but despite it all the share price highs of 2021 were three times what the much improved business trades at today.

Inflection Point: What may move the multiple?

There aren’t many healthy companies with a market cap less than three times management’s EBITDA guidance for next year but here we are.

Buybacks are underway but the cash on hand is a bit sparse so buybacks won’t be an enormous lever. The Swish lawsuit will play out in 2026 and any news of a settlement, win, or dismissal will move the stock price. Even a partial loss may be viewed positively as it removes the overhang of uncertainty that investors hate.

Trump has teased the idea of a complete elimination of taxes on gambling winnings. This would be an enormous boon to the industry and a departure from the tax changes implemented for 2026 in his Big Beautiful Bill which limited tax losses to 90% of total gambling losses. December 9th aboard Air Force One trump said,

"We have no tax on tips, we have no tax on Social Security, and we have no tax on overtime. No tax on gambling winnings? I don't know... I’ll have to think about that."

Like all trump musings it should be taken with sizeable salt, as it stands we’re one day away from taxes getting worse for gamblers on January 1st 2026.

The coming state legalizations are binary events which are easy to understand growth catalysts as America is Gambling.com groups largest single market. In 2024 US, Mexico, and Canada accounted for $55MM of their total $127MM in operating revenue. Ireland and the UK brought in $39MM. Americas dominance on their income statement only grew in 2025 and this is notable since online gambling was only legalized in the US in 2018, whereas GAMB formerly KAX media has had a 16 year presence in the UK/Ireland.

As the full breadth of American degeneracy is unlocked state by state we will see spikes in revenue and eventually a spike in that valuation multiple. But for a long term shareholder the longer valuation remains disconnected and depressed the longer GAMB can cheaply buy back shares, increasing our stake, and cheaply and tax efficiently compounding our EPS growth. The only time depressed stock prices are a bad thing is when you’re holding a bad business you want out of or the SBC outpaces share repurchasing.

The most likely catalyst to move investor sentiment is just continued quarterly growth. It’s a small cap sin stock but its well covered for its size and as the sexy SAAS data business outpaces the boring affiliate business someone at a bank will report the obvious long after its become obvious.

Management Ability & Ethics

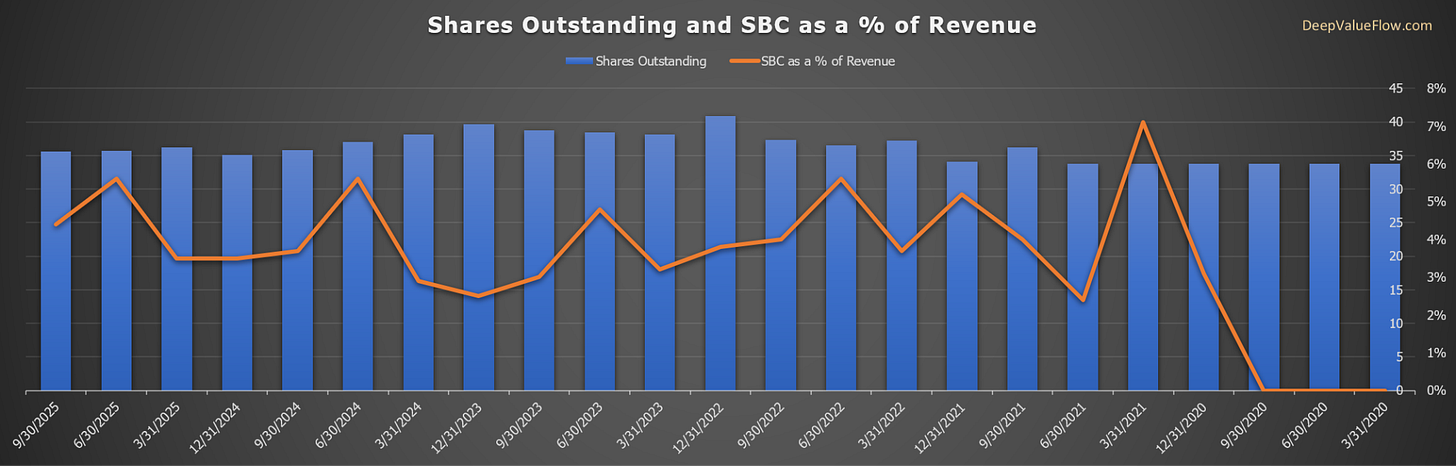

A good quick litmus test for ethics, alignment, and the health of free cash flow is how aggressively management uses stock based compensation relative to their revenue and free cash flow.

Since their IPO the value of their yearly SBC has increased 3.5x, while significant, it is still being outpaced by free cash flow growth which in 2025 is 4x what it was in 2021.

We can see stock based compensation is a factor worth watching sitting at around 4% of revenue. Since their IPO the company has generated $49.4MM in FCF of which they used a sizable $18.3MM for SBC. Roughly 37% of their total free cash flow has gone to employees, YTD that percentage of FCF flowing through to SBC has dropped to 21% which you would hope continues to drop as they grow.

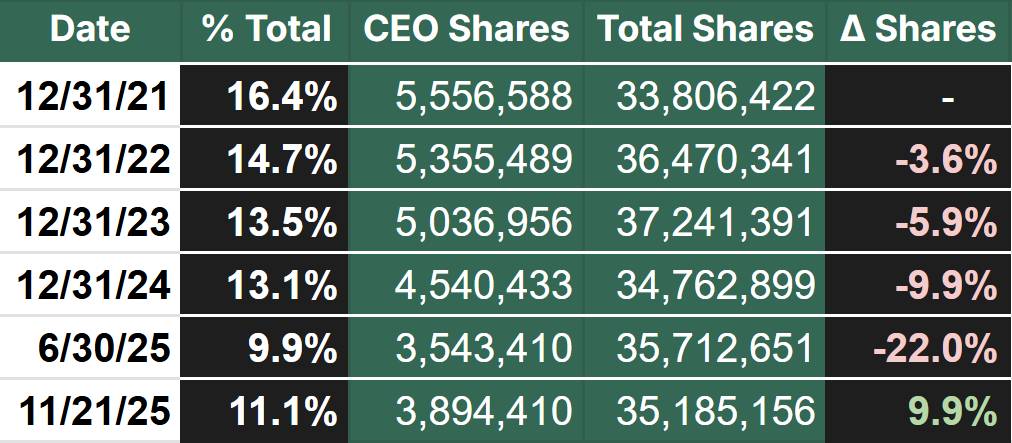

Looking at dilution as a whole we can see share count is relatively stable for a small young company as they rarely issue shares as a part of their acquisitions, using only $8MM worth of shares in their $180MM Odds Holding Acquisition. As I finalize this article on December 30th their CEO announced that of the remaining $60MM in Odds Holding earn outs they have agreed to pay $40MM early in all cash (saving themselves about $1.3MM in early payment).

This reaffirms my earlier point and also adds a potential stock price tailwind, the former odds holding owners might like to own a larger piece of their new combined business especially at these depressed prices and they were just handed $38,700,000 dollars by which to do it.

Insider ownership as it stands today shows CEO Charles Gillespie and his co-founder COO Mark Blandford maintain healthy large stakes in the business. Charles Gillespie has been slowly reducing his stake since the IPO but recently raised his stake for the first time to just over 11%.

In a later article I’ll look at their historical use of share repurchases and see if it looks to be a reasonable and consistent use of capital. But for the sake of brevity from what we’ve seen of his acquisitions play out, pace of historical growth, and what he’s said throughout 18 earnings calls I like him and his team. Talent as an operator is always tougher to quantify but his talent in capital allocation has been pretty darn good.

Prediction Markets, Risks, and Unknowns

To accurately assess a business it needs to be simple enough to understand, or you need to be sophisticated enough to understand complicated businesses. I can’t differentiate a soup spoon from a ladle so I stick with simple businesses and although ever expanding Gambling.com Group remains simple enough. The areas we need to explore deeper to get a full appreciation for the risks and strategic position of GAMB’s business are five fold:

Understand the health of the sportsbook and casino middle class. Gambling.com makes most their money with tier 2 & tier 3 operators and a single Casino/OSB ruling all is bad for business.

Assess the competitive landscape of the B2B odds platforms.

Quantify the risks from the fickle google algorithm and search rankings.

Understand where the industries of gambling and sports betting are going/growing and the impact of prediction markets within the US and abroad.

Determine the financial risk AI poses to search as we know it and how quickly it could reduce future affiliate revenue in a worst case scenario.

Quantify their exposure in the Swish Lawsuit, likelihood of future lawsuits, and subsequent repercussions on long term viability of their SAAS business.

I won’t cover it all here today but let’s examine the most impactful; AI and the meteoric rise of prediction markets, but first an uninformed comment on the lawsuit from a community college dropout.

Swish Analytics is a smaller private company that sued Odds Holding for scraping their data at the end of 2024. By headcount they are approximately a quarter of the size of GAMB and their case seems to have some validity as the first motion to dismiss was rejected at the beginning of the month. I believe GAMB has insulation from potential financial penalties of the Swish lawsuit as it was filed exactly a day before they acquired it. The Right of Set-Off allows any lawsuits pre buyout to be covered by future earn outs owed to the founders of odds holdings. Whether management expects to be indemnified from any financial penalties I’m not clear, they are certainly still paying lawyers fees and exposed to the more foundational risk that they get cut off from fanduel and bet365 analytics. If the case goes forward and they lose, they likely need to pay up to use the data or get locked out entirely, partially crippling some of OpticOdds offering and to a lesser degree OddsJam.

This is all speculation, I haven’t come across anything concrete outlining the specifics of their acquisition terms sheet or read any illuminating comments from management. I asked Gemini about the lawsuit but it didn’t add much and even worse when asked for a good sportsbook in NY it sourced SportsHandle.com which is run by Better Collective GAMB’s nemesis in the affiliate business.

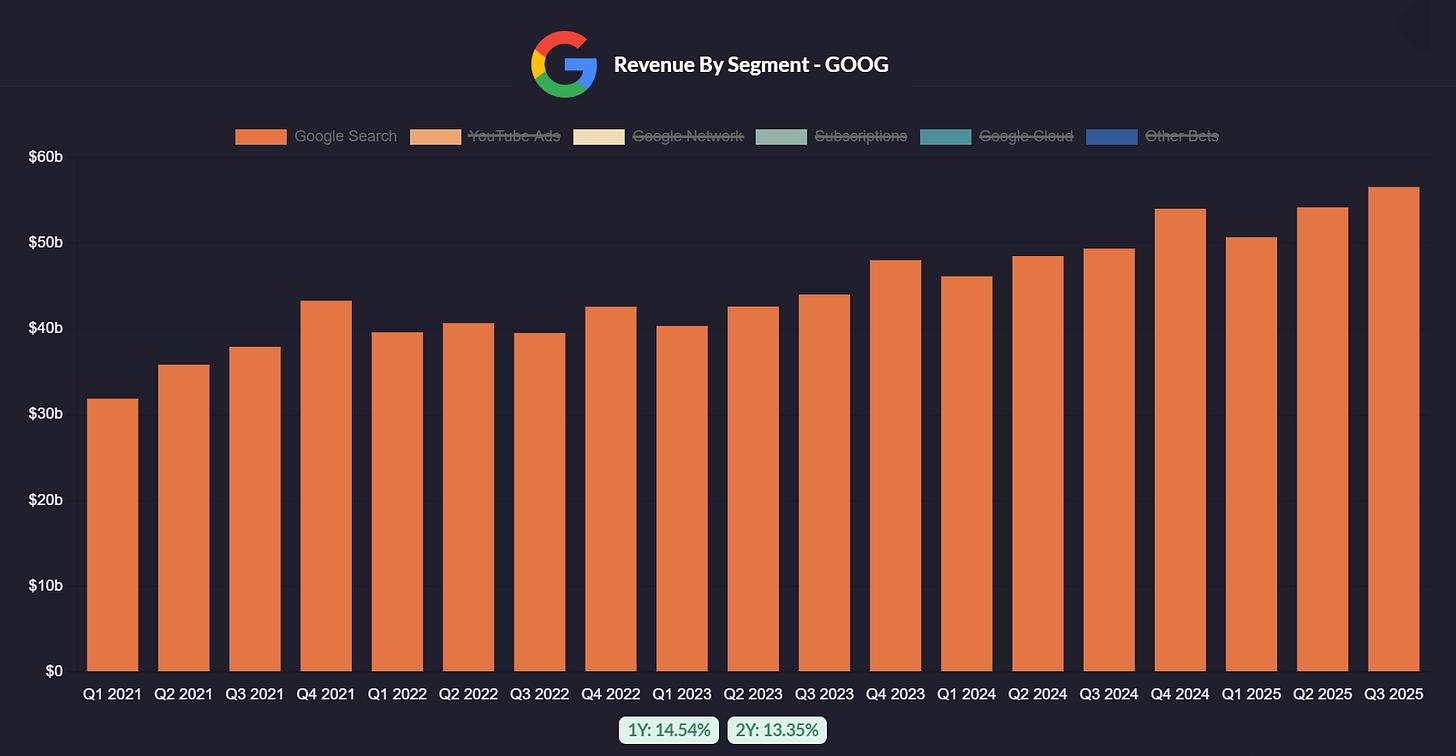

Much of this 63% YTD decline in share price is owed to fear surrounding the expected AI assisted suicide of their affiliate search business. AI may kill search as we know it one day but a quick look at google’s search revenue show’s us it is not this day.

The plain reality is google search remains strong and they are incentivised more than anyone to maintain its integrity while integrating it further into Google Gemini.

Uncertainty around GAMB’s place in this AI future, in part, is what led to this value investing opportunity. AI and the rapid rise of prediction markets threaten to reshape the landscape of both their businesses. Prediction markets in particular are expanding aggressively into sports betting where it offers systemically superior margins. Although regulation is still in flux, it is plausible that Polymarket and Kalshi will remain available in states and to age groups (18-20) where sports betting is still illegal. The market doesn’t like uncertainty, but there’s good reason to expect this prediction market growth while cannibalistic to existing sportsbooks will be additive to the overall growth of the industry bringing new customers that GAMB can continue to profitably funnel to a changing landscape of operators.

The risk for GAMB is that prediction markets inherently improve with more users and greater liquidity which may lead to a winner takes all situation. By contrast FanDuel and DraftKings together command around 60% of the sportsbook market in the US which leaves a large healthy market of second tier and smaller niche operators which are Gambling.com Group’s bread and butter. Small sportsbooks can’t afford to spend the millions per year in compute required for up to date odds and bet settlement, OpticOdds offers this to them at a fraction of the price.

While sportsbooks are regulated by state Gaming Commissions the prediction markets fall under the purview of the Commodity Futures Trading Commission and are regulated at the federal level. As it stands in the US 19 states have yet to legalize online sports betting most notably California, Texas, and Georgia. Those 19 states account for 37% of the US population, a 124,000,000 untapped market that prediction markets are unlocking. If Gambling.com can integrate themselves deeper with prediction markets through both the customer funnel portion of their business and the odds data services business, this potential risk becomes a huge tailwind.

Where things get murky for GAMB is in their ability to sell OpticOdds services to prediction market makers. Prediction market odds are self setting, for every winner there is an equal loser. A zero sum game where the probability becomes the payout doesn’t require risk mitigation services the way a traditional sportsbook operator needs to balance exposure to guarantee profit. They only really need binary bet settlement and the starting point for the original line.

Timely bet settlement as it relates to sports betting is where OpticOdds has a use case. This service could be further expanded if prediction markets get deeper into live sports micro market betting. As it stands OpticOdds is the primary sports data partner for both Kalshi and Polymarket. They are also used by Robinhood and indirectly by Coinbase both of whom use Kalshi under the hood for their prediction market offerings. GAMB is perhaps best positioned to profit from prediction markets through their traditional affiliate marketing, media partnership advertising, and public facing OddsJam subscriptions. It seems the market is missing the explosive growth opportunity of prediction markets that GAMB is just starting to capture.

Conclusion

Often in value investing we must find mispricings by looking at debt-laden declining businesses or businesses otherwise encumbered by some combination of misfortune or managerial shortcoming - the longer I looked into Gambling.com the more I liked and the farther the stock price fell. We are looking at a business with consistent double digits revenue/FCF growth and a low single digits valuation that has multiple regulatory tailwinds, an aligned management, is capital light, has reasonable debt, durable 49% recurring revenue, fruitful acquisitions, is in a growing industry and its trading as though the business is dying while it’s rapidly growing, de-risked, and diversified.

A single year of slow down in their core affiliate business (from a google search update that erroneously prioritized spam content overseas) does not justify a valuation multiple under 4x FCF when the company as a whole is maintaining strong growth and guiding for more strong growth. Operating expenses need to be monitored as the company now manages ever higher headcounts across two distinct business segments. Despite these challenges it should be trading at a premium and the $14.4MM in share repurchases coming down the pipe will be a welcomed boon to my EPS in the coming years as top and bottom-line growth continues (at least until they effectively undo it in ~8 quarters with stock based compensation). It’s a tragedy they don’t have more dry powder to use on buybacks but as it stands they will end 2025 with roughly $114MM in net debt. In addition to that they have a discounted fair value of non-current contingent considerations from Q3 2025 of $16.1MM which will be raised to ~$42MM in Q4 to reflect the discounted fair value of the final $40MM in contingent considerations owed for Odds Holding on April 1st 2027 as well as a max of $22MM owed to Spotlight.Vegas, half due April 1st 2027 and the second half due a year later. This definitely limits buybacks and acquisitions in 2026 but is not yet a concern considering FCF is north of $40MM a year, they should have over $50MM in undrawn credit, and they remain under their wells fargo leverage covenant of 3:1.

Accounting for SBC the adjusted EBITDA since the 2021 IPO has grown from $16.4MM to an expected $44.7MM in 2025 - that’s a CAGR of 28.5%. Next year’s conservative management estimate of $63MM in adj EBITDA (after subtracting $8MM in SBC) would put us at another year of 23% growth.

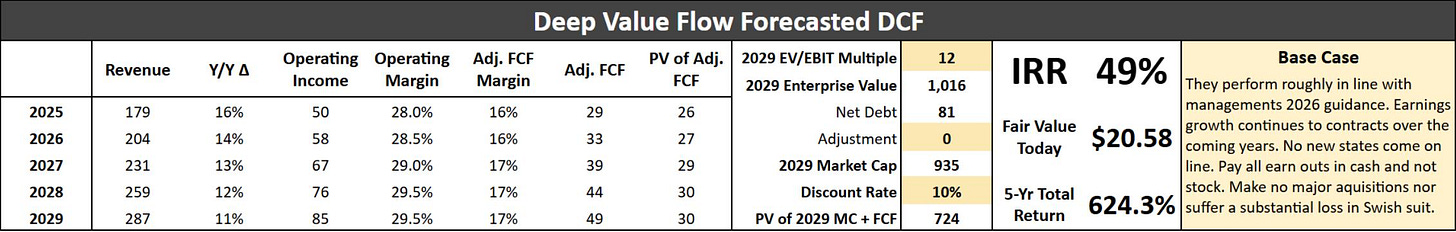

My base case DCF above assumes 2026 revenue and margins mildly underperform management’s expectations and then averages 12.5% growth thereafter as operating margins stabilize below historical levels. Assuming a modest terminal multiple the stock is a 7-bagger with a fair value today of $20.58. If growth instead were to match historical levels and it is assigned a multiple to match it becomes even more wildly lucrative. The margin of safety here is so great that either of their business segments could fail completely in 2026 and the remaining segment would still justify today’s enterprise value.

I like the risk reward here the death of search has been exaggerated - the major acquisitions have been fairly priced and have set them up with a hand in every pot: gambling, sportsbooks, and entertainment all while avoiding the regulatory risks inherent in those businesses.

I’m long GAMB and a repeat college dropout, not your financial advisor. This is opinion/entertainment, not investment advice. Do your own research; you can lose money. I may buy/sell anytime without notice. No compensation from any company mentioned. Position Initiated September 2025; avg cost ≈ $6.12

Nice post! I’m holding DDI and GAMB in size.

Thanks for detailed analysis. Subscribed ✅. Waiting for next part….