Autism, Acetaminophen, RFK, and FCF

Is tylenol stock KVUE oversold and undervalued?

KVUE shares have fallen over 20% on political headlines and media coverage disproportionate to Tylenol’s actual revenue contribution.

Even under extreme assumptions, pregnancy-related Tylenol use represents <1% of company revenue, suggesting an overreaction.

KVUE maintains durable brands and a high dividend yield, but payout levels and slow growth raise sustainability concerns.

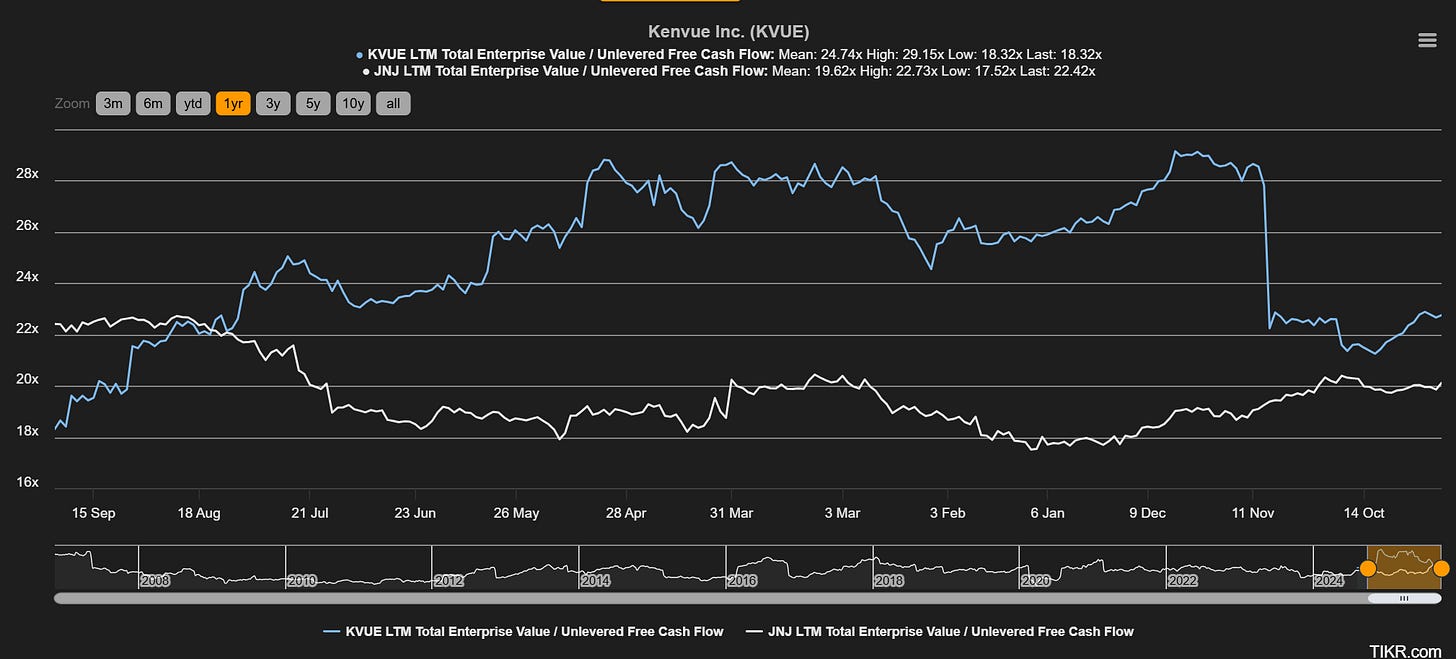

The FCF yield is now higher than its former parent JNJ, if multiples continue to compress it could become attractive.

When the President of the United States holds a dedicated press conference linking your product to autism it’s a bad day for business. But like most financial headlines the reaction is often worse than the reality and therein often lies opportunity.

Shares of Kenvue Inc. (NYSE:KVUE) are down 11.8% just 3 days after RFK Jr. and President Trump warned pregnant women, “Don’t take Tylenol. Don’t take it.” and cumulatively down 21.3% since the WSJ scooped the impending announcement 2 weeks prior.

The reaction from the media has been largely skeptical and critical as they are with all Trump assertions. It’s difficult to determine what the epistemological truth is regarding these claims, that’s above my intellectual competency.

So whether the new Department of Health and conservative President are correct, or whether journalists — educated by liberal professors, employed at liberal publications, headquartered in liberal cities, and reliant on pharmaceutical companies for 40% of ad revenue — are right, it’s not something I can competently conclude

Luckily I don’t need to, it’s much simpler to estimate how much revenue tylenol contributes to Kenvue and see if a substantial decline in that income would be commensurate with the market reaction. Spoiler, it’s not.

Tylenol accounts for less than ~10% of their revenue. Pregnant women account for 2% of the population and generously assuming they take tylenol at 400% the normal rate -pregnant tylenol use would account for 8% of total tylenol sales. If no pregnant woman swallows another tylenol then KVUE revenue would drop less than 0.8%. The 21.3% drop in share price, although part of a pre-existing downward trend, is an overreaction.

Obviously there’s further incalculable brand damage and it certainly doesn’t help existing Tylenol lawsuits that are still in appeals when the FDA adds a warning to your label that it “may be associated with an increased risk of neurological conditions such as autism and ADHD in children”.

This offshoot of JNJ is no stranger to consumer harm cases, when it was a division of JNJ their asbestos contaminated Talc-based baby powder led to one of the largest ongoing landmark consumer harm cases in American history. Part of the reason KVUE was spun off was to rid JNJ of the risk of future consumer lawsuits. For their part KVUE is indemnified for the baby powder cases and have since switched to corn starch.

Overall I see the net effect on revenue and legal risk as minimal. The reaction thus far appears to be disconnected from reality but has it made KVUE an attractive investment?

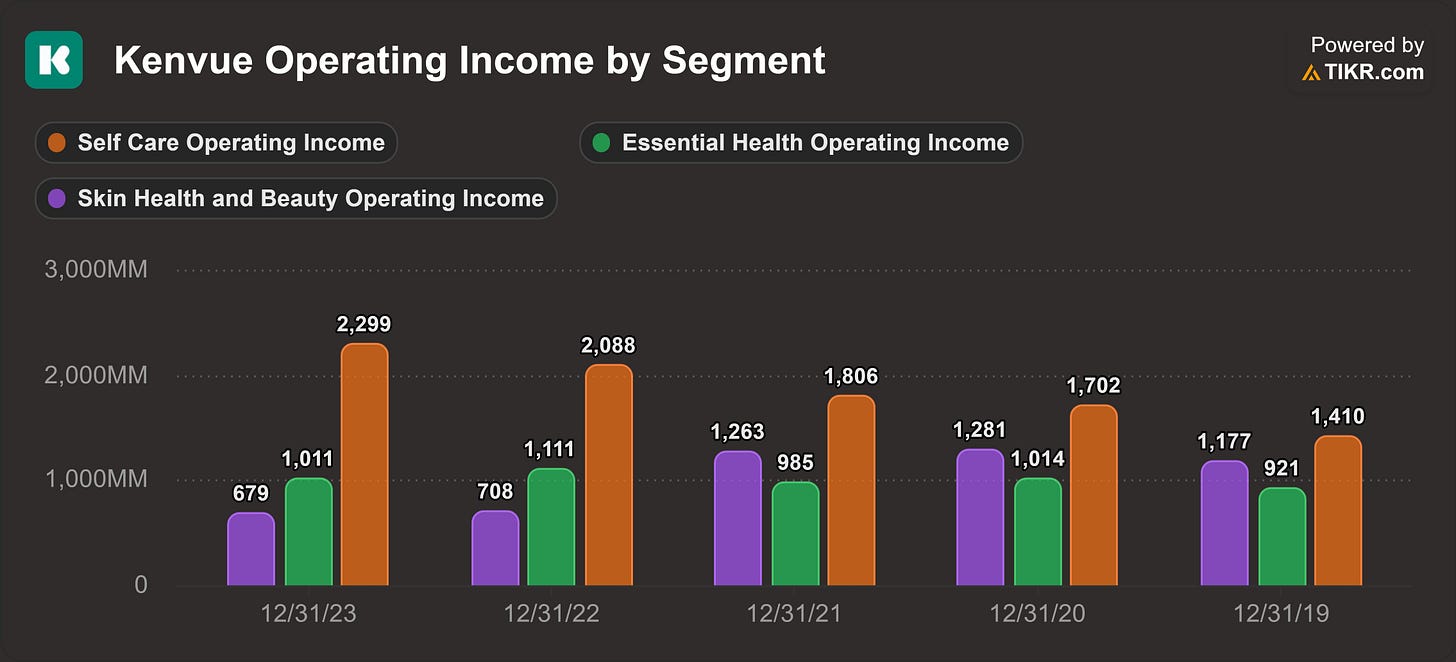

Kenvue is the slow growing former consumer health division of JNJ, they were spun off in 2023 primarily so JNJ could focus on, and be valued by, their promising high growth divisions. KVUE has 3 primary segments that house huge name brands:

Self care: Tylenol, Motrin, Benadryl, Nicorette, and Zyrtec

Essential Health: Listerine, Johnson’s, Band-Aid, and Stayfree / o.b. tampons

Skin & Beauty: Neutrogena, Aveeno, Dr.Ci:Labo, Lubriderm, and Rogaine

Mind share is extremely valuable and a potent contributor to that durable competitive advantage Buffett is always bandying about. When a product is so ubiquitous in language that it replaces the product category it becomes tough to usurp when it carries recognition without ad spend. People don’t ask for a face tissue or a cola; they ask for a Kleenex and a Coke. Proprietary eponyms are the height of mind share and KVUE owns 4 of them: Band-Aid, Tylenol, Rogaine, and Benadryl.

Unfortunately revenue growth reflects the maturity of this mind share - it has averaged a measly 1.54% over the last 4 years. That’s why stalwarts are a tough category of businesses to invest in. As of 9/25/25 they have a market cap of $32.3B, reasonable net debt of $7.6B, and healthy double digit ROIC of 13.4%. Dividend yield sits at 5.2% and their dividend payments in 2024 were 16.7% larger than their free cash flow that year - that’s not sustainable. JNJ was a dividend king, 63 years of increasing its dividend without fail. Roughly 75% of KVUE investors are former JNJ shareholders, many of whom are dividend investors. If the dividend gets cut, they will lose many of those investors.

Over the last 12 months they issued $193MM in stock-based compensation, repurchased $271MM in stock, paid $1,571MM in dividends and brought in $1,627MM in FCF. The relatively minuscule buybacks relative to dividends tells us management doesn’t think the business was priced particularly attractively this year. Looking at the EV/FCF, I would have to agree but thanks to the sell off it’s trending in the right direction.

There’s no need to dig deeper into management, for me the value isn’t there yet. I love quality brands even when they’re generic antihistamines and hair loss foams, but I don’t love paying 18x FCF for a stalwart that just got put on notice by a Kennedy. I would need to see the EV/FCF multiple drop below 12x before I would be interested in KVUE. I’ll keep an eye on it, Q3 earnings are in November, if the sell off continues and share prices fall a further 34% to $10.65 I would start a position.